Description

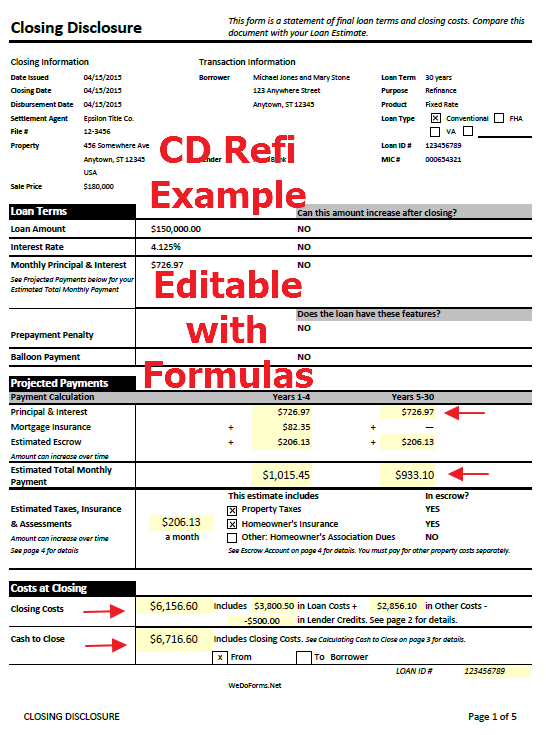

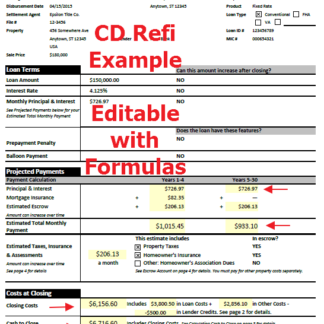

Now you can produce a Professional looking Closing Disclosure Form Refinance for all Refinance Closings.

Refinance Closing Disclosure Software

Closing Disclosure Form Refinance Features

- Professionally formatted.

- Formulas help with calculations and totals

- Tax Proration Formulas

- Unlimited use make as many Closing Disclosures as you need

- Letter size 8.5 x 11

- Easy to adjust numbers or make changes

- Digital delivery – no waiting for shipment

- Download after Payment

- Customize it – Change the font type, font size, etc.

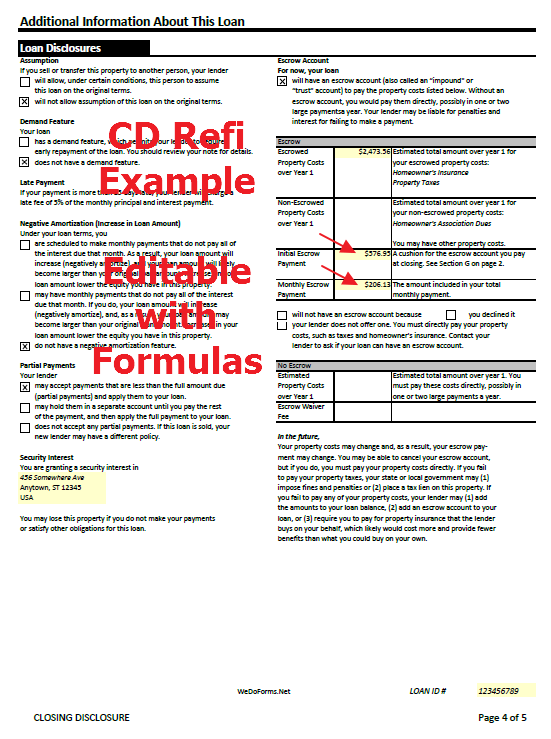

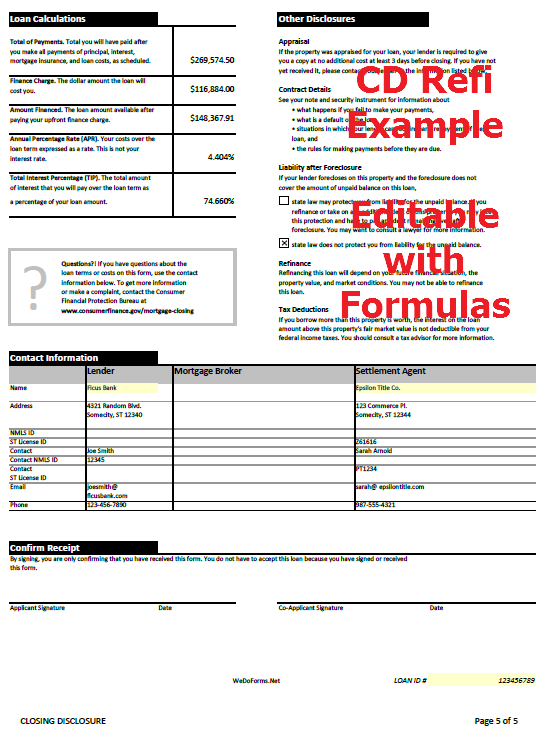

- 5 standard pages

- Excel spread sheet

- Works on Mac or PC, if you have Excel or openoffice.org (free)

Benefits

- Quickly and Easily Create Closing Disclosures

- 1 time fee for Unlimited use

- No Waiting on someone else, you can create your Closing Disclosure whenever you want.

- Save as PDF files – to Email to lenders or clients

- Easy to do, just type in your information and print a professional copy.

- Simple to use

- Easily open Closing Disclosures and make quick changes, if needed.

- No upgrades to purchase

- No Monthly fees

- No Registration codes

- 100% Satisfaction, 30 Day Money back Guarantee

Bonus

- Sample copy of a Closing Disclosure Refinance – with sample data and numbers to use as a reference.

What can a homeowner expect when closing on a refinance?

The closing process can occur in a number of locations including the office of your title company, Loan Originator, your real estate attorney or another location.

At your closing, you’ll want to:

Fully review and sign all of your loan documents, ensuring that you completely understand the term layer to which you are agreeing.

Supply evidence of homeowner’s insurance and inspections

Present a certified or cashier’s check made out for the amount of your closing costs, prepaid interest, taxes and insurance.

Based on the terms of your loan, you may be asked to set up a new escrow account to ensure that your property taxes and homeowner’s insurance can be paid along with your monthly mortgage payment.

What documents will you sign?

The purpose of closing is primarily to review and sign documentation that locks you into your refinance. You can expect to sign the following documents during closing:

Closing Disclosure:

This is the itemized list of the final charges for your loan. Each borrower and person who has ownership of the property must receive the Closing Disclosure at least three business days before the scheduled closing in order to have time to review the final figures and compare them to the Loan Estimate.

Deed of Trust or Mortgage:

These documents outline your agreement to a lien on your property, and provide security for repayment of your home mortgage.

The Promissory Note:

The mortgage promissory note is a document that legally binds you to pay your lender according to the agreed terms, including mortgage payment dates and where the payments should be sent.

Our Closing Disclosure Form Refinance – is a great way to provide a professional looking form to your clients for a one time fee and unlimited use.