Description

Who needs the Alta Settlement Statement?

Real Estate Closing professionals that need to share itemized closing costs numbers with all parties involved in the closing like attorneys, title companies, escrow firms, agents, realtors, sellers, etc.

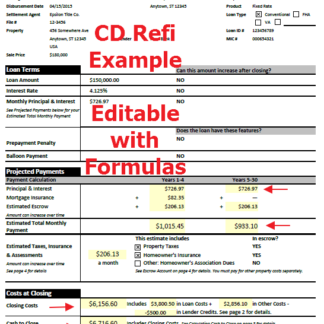

The Problem: The standard 5 page Closing Disclosure Statement is only for the borrower. Due to privacy laws it is not to be shared with others, unless there is written consent.

Features:

- Professionally formatted

- Formulas help with calculations and totals

- Tax Proration Formulas

- Unlimited use make as many as you need

- Easy to Edit numbers or make changes

- Digital delivery – no waiting for shipment

- Download after Payment

- Customize it – Change the font type, font size, etc.

- Letter size 8.5 x 11

- 3 standard pages

- Excel spread sheet

- Download and Keep on your Computer

- Works on Mac or PC, if you have Excel or LibreOffice (free)

Benefits:

- Quickly and Easily Alta Settlement Statements

- 1 time fee for Unlimited use

- No Waiting on someone else, you can create your Alta Settlement Statements whenever you want.

- Save Closing Disclosure PDF files – to Email to lenders or clients

- Easy to do, just type in your information and print a professional copy.

- Simple to use

- Easily open Closing Disclosures and make quick changes, if needed.

- No upgrades to purchase

- No Monthly fees

- No Registration codes

- 100% Satisfaction, 30 Day Money back Guarantee

What is the Alta Settlement Statement?

ALTA statements were put into use to provide thorough breakdowns for agents and brokers to receive at the end of the transaction.

An ALTA settlement statement is provided during the closing of a transaction and contains solid numbers rather than estimates.

These sheets help itemize all the fees and charges that both the home buyer and seller must pay during the settlement process of a housing transaction.

What is the difference between Closing Disclosure vs Alta Settlement Statement?

The Closing Disclosure Form (CDF) is the settlement statement that replaced the HUD, only it is designed strictly for the buyer only. It contains information specific to their loan amount, closing costs, loan terms, and other such personal information. As a result, this form is signed only by the buyer, and the title company and lender are instructed by law to only share this form with the buyer.

Because the sellers will also need a settlement statement (CDF) – and because this is not provided by the buyer’s lender like the buyer CDF is – it is the responsibility of the Title Company to now create and provide this additional document. As this is a new, additional form not required in the past, it has become the norm in the industry now for the title company to charge a fee for this form, payable by the sellers.

Now, real estate agents and brokers have been used to receiving a copy of the old HUD in the past, however, due to new TRID regulations and privacy restrictions, they are no longer permitted to view or receive copies of these new CDF’s. As such, ALTA has designed a form they are calling the “ALTA Settlement Statement”. This form is specifically for the agents and brokers to receive at the end of the transaction. There is a separate one for the Buyer Agent and another for the Selling Agent. These may be used as a disbursement sheet, as well as an additional disclosure for recording fees, assessments or any other fees that require further itemization or disclosure.

Consumer protection laws often prevent lenders from distributing Closing Disclosures to real estate agents due to the sensitive information they contain. That’s the main reason why the ALTA Settlement Statement was created—to protect your privacy and ensure agents and brokers have the info they need to assist you at closing.

A Hud-1 used to be the primary statement associated with real estate and is used to document all cash transactions and how they affect both parties. It is now outdated. The Closing Disclosure timeline was introduced in 2015 as a document that instead contains this information strictly for the buyer. ALTA settlement statement sheet was put into use to provide thorough breakdowns for agents and brokers to receive at the end of the transaction.

The ALTA Settlement Sheet doesn’t have the same level of personal detail as the Closing Disclosure form, so it can be shared with all parties involved in a real estate transaction.